-

PAMP Suisse 500 Gram Gold Bar

Regular price £53,204.00Regular price £53,204.00 Sale priceUnit price per -

PAMP Suisse 1 Kilo Gold Bar

Regular price £10,608.00Regular price £10,608.00 Sale priceUnit price per -

2021 Queen’s Beasts Completer 1oz Gold Coin

Regular price £4,985.50Regular price £4,985.50 Sale priceUnit price per -

2024 Seymour Unicorn 1oz Gold Coin

Regular price £4,252.00Regular price £4,252.00 Sale priceUnit price per -

2018 Queen’s Beasts Black Bull 1oz Gold Coin

Regular price £3,970.00Regular price £3,970.00 Sale priceUnit price per -

2022 Britannia 1oz Gold Coin

Regular price £3,950.00Regular price £3,950.00 Sale priceUnit price per -

2023 Bull of Clarence 1oz Gold Coin

Regular price £3,923.00Regular price £3,923.00 Sale priceUnit price per -

2023 Yale of Beaufort 1oz Gold Coin

Regular price £3,860.00Regular price £3,860.00 Sale priceUnit price per -

2026 Britannia 1oz Gold Coin

Regular price £3,475.00Regular price £3,475.00 Sale priceUnit price per -

Lakshmi 20g Gold Bullion Minted Bar

Regular price £2,100.00Regular price £2,100.00 Sale priceUnit price per -

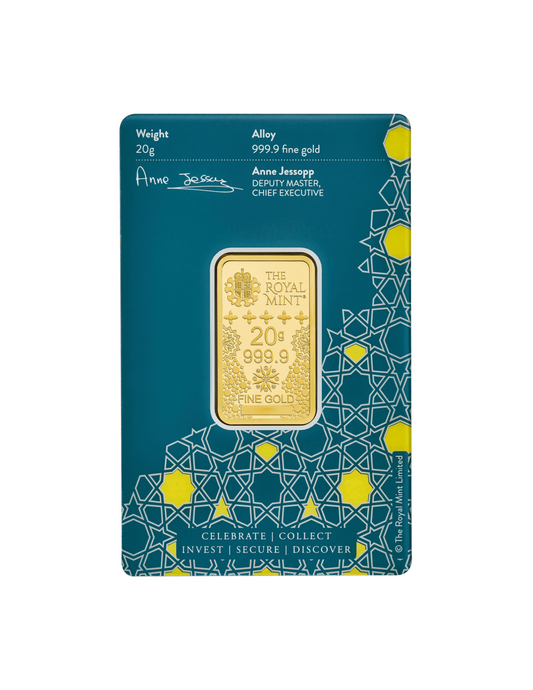

Kaaba 20g Gold Bullion Minted Bar

Regular price £2,100.00Regular price £2,100.00 Sale priceUnit price per -

2026 Britannia 1/2oz Gold Coin

Regular price £1,737.50Regular price £1,737.50 Sale priceUnit price per -

2024 Four Nations 1/4oz Gold

Regular price £1,120.00Regular price £1,120.00 Sale priceUnit price per -

2026 Britannia 1/4oz Gold Coin

Regular price £775.00Regular price £775.00 Sale priceUnit price per -

2026 Gold Sovereign Coin

Regular price £358.00Regular price £358.00 Sale priceUnit price per

Your Questions Answered

Why should I consider investing in gold coins?

Why should I consider investing in gold coins?

Gold has long been recognised as a store of real value. Unlike paper-based or digital assets, physical gold is tangible and held outside the banking system.

UK legal-tender gold coins are also exempt from Capital Gains Tax, making them a secure and tax-efficient way to preserve wealth over the long term.

Why do people prefer coins over gold bars?

Why do people prefer coins over gold bars?

Coins are practical, flexible and easy to liquidate. Because they’re legal tender, they’re tax-free and can be sold individually or in small quantities when needed. Gold bars don’t share these tax advantages and are often less flexible when it comes to resale.

Why gold over silver?

Why gold over silver?

Gold and silver serve different roles. Gold is typically favoured for wealth preservation due to its lower volatility, higher value density and long-standing role as a monetary reserve asset.

Silver can offer greater price movement, but gold is generally chosen for stability, liquidity and long-term capital protection. Many investors hold both, depending on their objectives and risk tolerance.

Is gold still performing well today?

Is gold still performing well today?

Gold has performed well over the long term. Although prices can fluctuate in the short term, gold’s primary role is stability and capital preservation, particularly during periods of inflation and economic uncertainty.

Do I need to pay tax when I buy or sell gold coins?

Do I need to pay tax when I buy or sell gold coins?

No. UK legal tender gold coins are VAT-free and exempt from Capital Gains Tax, meaning any profit you make from future sales is 100% yours. This is one of the main reasons why gold coins remain so popular with UK investors.

How much do I need to get started?

How much do I need to get started?

There is no fixed minimum. Some individuals begin with a modest allocation, while others commit larger amounts depending on their objectives and circumstances.

The starting point is determined by what you are looking to achieve over the long term, not by a predefined figure. Guidance is provided to help you decide whether an allocation makes sense and at what level.

Where can I store my gold?

Where can I store my gold?

Precious metals are commonly stored at home in a personal safe. Secure, fully insured external vaulting options are also available if preferred.

How do I know if the gold is real?

How do I know if the gold is real?

All precious metals supplied are sourced directly from the Royal Mint and refined by LBMA-accredited refiners. Verification checks are carried out prior to dispatch and graded coins can be independently confirmed through NGC or PCGS.

How secure is delivery?

How secure is delivery?

All orders are dispatched using Royal Mail Special Delivery, which provides full tracking and insured transit.

Delivery typically takes 2 to 3 working days once payment is received. Tracking details are provided when the order is dispatched.

Can I sell my gold back to you later on?

Can I sell my gold back to you later on?

Yes. Physical gold and silver are highly liquid assets with an active global market.

If you choose to sell in the future, guidance can be provided on available options at the time, including selling back through Gold Tier Advisory or through the wider market, depending on circumstances.

What experience does Gold Tier Advisory have?

What experience does Gold Tier Advisory have?

We bring together decades of combined experience in the precious metals market and have been operating independently for several years.

Our experience is not defined solely by time in operation, but by informed guidance, consistent execution and the confidence our clients place in us.

How can I speak to someone directly?

How can I speak to someone directly?

Contact can be made by phone on 0208 064 0076, Monday to Friday, 9am to 5pm.

For written enquiries, WhatsApp is also available at any time.

Still have questions?

Still have questions?

If you would like to discuss this further, a private conversation can be arranged using the booking form below.